If you have to sell inventory for a deep discount, you could deduct it from your year-end taxes. If you check regularly (and compare to prior months’ numbers), it’s easier to make adjustments, so you are neither short nor overloaded. Business bank reconciliation makes it easier to discover and correct errors or omissions—either by you or the bank—in time to correct them.

What this means is that for each journal entry, two accounts are affected at one time. The act of bookkeeping produces financial statements, which your CPA then uses to file your taxes and make strategic financial decisions that help your business grow. The difference between the two is important to understand; your business’s accounting method will affect cash flow, tax filing, and even how you do your bookkeeping. If you’re self-employed, you’ll pay self-employment taxes, which is a little different from small-business taxes and personal taxes. You can get more guidance on how to record and pay a small-business tax with your accounting software and tax professional. Here are some basic steps to get you started keeping track of your small business’s financial information, generating financial statements, and filing taxes.

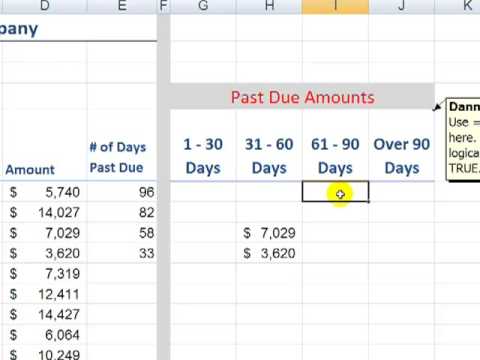

An accountant can help you ensure that you are in a financial position to apply for a business loan. Read this guide to discover financial reporting and the different accounting systems, accounting software, and whether you can do your own small business accounting. Based on the nature of your business, you might decide to offer credit to customers. Instead of collecting payments at the point of sale, you may choose to invoice them at a later date.

However, their large size leads some small business owners to prefer smaller accounting firms that will not lose them among their larger clients. Smaller firms are generally much less expensive and can provide face-to-face service. These applications automatically crunch numbers, perform data entry, track performance metrics, and produce business reports.

Employment tax (payroll taxes)

Remember, any time you record a journal entry, there always needs to be a debit and a credit entry. In order to follow the accounting equation, all entries made into your general ledger need to have a debit entry and a corresponding credit entry. By knowing what you need to do and getting some guidance on how to do those things, you can be performing accounting tasks for your business in no individual income tax forms time. Accounting software ranges in price from free to hundreds of dollars a month. And generally, no matter the plan or price, accounting software is more reliable than by-hand spreadsheet accounting.

But nothing beats up-front, personalized advice from a certified professional—in this case, a bookkeeper, accountant, or CPA. Bookkeepers, accountants, and CPAs all bring something different to the table. Track all invoices received from vendors (also known as accounts payable) and make sure you have the cash available to pay suppliers on time. If vendors offer discounts for early payments, you may want to take advantage to reduce costs. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business.

- An accountant can help you ensure that you are in a financial position to apply for a business loan.

- This is a necessary chore that helps small business owners track and manage their money effectively – especially during the early stages.

- Large and inventory-heavy businesses may need to use the accrual method.

- If you are unsure, weigh the initial costs against what a firm can save your company over time.

- As a business owner, accounting is probably the last thing you want to worry about.

Get clear on your tax obligations

The owner’s equity is what’s left after liabilities are subtracted from assets. However, maintaining proper accounting is important for your business to grow and succeed. Before adding anyone to your payroll, make sure your workers are categorized correctly as either employees or independent contractors. Just like a regular bank, every payment provider will have a different fee structure. Before you commit, make sure you do the math to determine the impact a provider’s fees will have on your bottom line.

At the same time, accountants are increasingly expected to be proficient in using software to support small businesses with their accounting and financial needs. As a small business owner, you have the option of hiring an accountant, recording transactions by hand or using an accounting software to record your business transactions. While most larger businesses have an accounting staff that takes care of financial transactions, as a small business owner, the job of accountant typically falls to you. For business owners without a bookkeeping or accounting background, the prospect can be overwhelming. If you set up your finances with accrual-basis accounting, you’ll record financial transactions when they occur, not when the money moves accounts.

Setting Up Accounting for Small Businesses

One of the main differences between accounting and bookkeeping is that accounting involves more than just recording financial transactions. It also includes you analyzing, interpreting, and communicating financial information. This is a necessary chore that helps small business owners track and manage transaction 2021 their money effectively – especially during the early stages. Besides keeping you cognizant about your business’ past and present performance, small business accounting also helps in generating invoices and completing payroll. Whereas double-entry bookkeeping is based on the accrual-accounting method.

She has worked in the private industry what does organization name mean on a job application as an accountant for law firms and ITOCHU Corporation, an international conglomerate that manages over 20 subsidiaries and affiliates. Lizzette stays up to date on changes in the accounting industry through educational courses. It depends on the size of your business and the complexity of its operations. Outside accountant costs typically increase with the size of the business.