The net balance of the income summary account is closed to the retained earnings account. The net amount transferred into the income summary account equals the net profit or net loss that the business incurred during the period. Thus, shifting revenue out of the income statement means debiting the revenue account for the total amount of revenue recorded in the period, and crediting the income summary account. At the end of each accounting period, all of the temporary accounts are closed. This way each accounting period starts with a zero balance in all the temporary accounts, so revenues and expenses are only recorded for current years.

Closing Entry

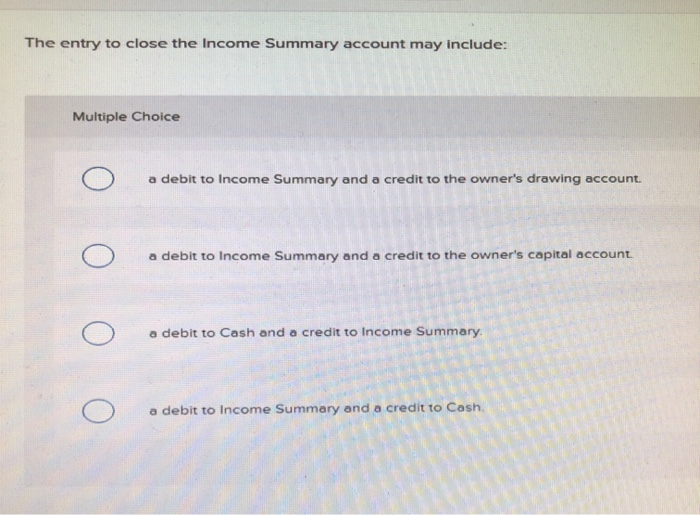

Note that by doing this, it is already deducted from Retained Earnings (a capital account), hence will not require a closing entry. Take note that closing entries are prepared only for temporary accounts. Close the income summary account by debiting income summary and crediting retained earnings. You need to create closing journal entries by debiting and crediting the right accounts. Use the chart below to determine which accounts are decreased by debits and which are decreased by credits. Now that the journal entries are prepared and posted, you are almost ready to start next year.

Step 2: Close Expense accounts

If you have only done journal entries and adjusting journal entries, the answer is no. Let’s look at the trial balance we used in the Creating Financial Statements post. Think about some accounts that would be permanent accounts, like Cash and Notes Payable. While some businesses would be very happy if the balance in Notes Payable reset to zero each year, I am fairly certain they would not be happy if their cash disappeared. Assets, liabilities and most equity accounts are permanent accounts.

Closing Entries

- Carter earned his Bachelor of Science in accounting from Eastern Illinois University.

- The second is to update the balance in Retained Earnings to agree to the Statement of Retained Earnings.

- Debit the income summary account and credit expense account.

- While some businesses would be very happy if the balance in Notes Payable reset to zero each year, I am fairly certain they would not be happy if their cash disappeared.

- In other words, the income and expense accounts are “restarted”.

Closing the income summary account is done after all income sources are accounted as retained earnings of the organization. But before that entry is passed, there are a few steps to the process. In a sole proprietorship, a drawing account is maintained to record all withdrawals made by the owner. In a partnership, a drawing account is maintained for each partner.

Closing the net income to retained earnings

In other words, the income and expense accounts are “restarted”. You need to use closing entries to reduce the value of your temporary accounts to zero. That way, your next accounting period does not have a balance in your revenue or expense account from the previous period. The income summary account is a temporary account that the company uses at the end of the accounting period to transfer the resulting of net income or net loss to the retained earnings account. The company can make the closing entry for expenses by debiting the income summary account and crediting all expenses accounts. Additionally, it is important to note that the income summary account plays both roles of the debit and the credit at the same time when the company closes the income statement at the end of the period.

Transferring funds from temporary to permanent accounts also updates your small business retained earnings account. You can report retained earnings either on your balance sheet or income statement. Without transferring funds, your financial statements will be inaccurate. The balance in dividends, revenues and expenses would all be zero leaving only the permanent accounts for a post closing trial balance. The trial balance shows the ending balances of all asset, liability and equity accounts remaining.

My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

The income summary is a temporary account used to make closing entries. Debit the company’s revenue account for the balance how to make an invoice in the revenue account. For instance, a company with a $10,000 balance in revenue must debit revenue for $10,000.

Income Summary allows us to ensure that all revenue and expense accounts have been closed. However, some corporations use a temporary clearing account for dividends declared (let’s use “Dividends”). They’d record declarations by debiting Dividends Payable and crediting Dividends. If this is the case, then this temporary dividends account needs to be closed at the end of the period to the capital account, Retained Earnings. When dividends are declared by corporations, they are usually recorded by debiting Dividends Payable and crediting Retained Earnings.

So, even though the process today is slightly (or completely) different than it was in the days of manual paper systems, the basic process is still important to understand. Now that Paul’s books are completely closed for the year, he can prepare the post closing trial balance and reopen his books with reversing entries in the next steps of the accounting cycle. It is also commonly found that an income summary is confused with an income statement.