Unlike the unadjusted or adjusted trial balances, the post-closing trial balance includes only permanent accounts, such as assets, liabilities, and equity accounts. Temporary accounts, which are reset to zero at the end of each period, do not appear on this trial balance. The post-closing trial balance double-checks a company’s financials for a fiscal year, keeping everything accurate. It ensures all debit and credit entries match up perfectly after closing entries. This makes sure the company is ready for the new accounting year. They are an unadjusted trial balance, adjusted trial balance, and post-closing trial balance.

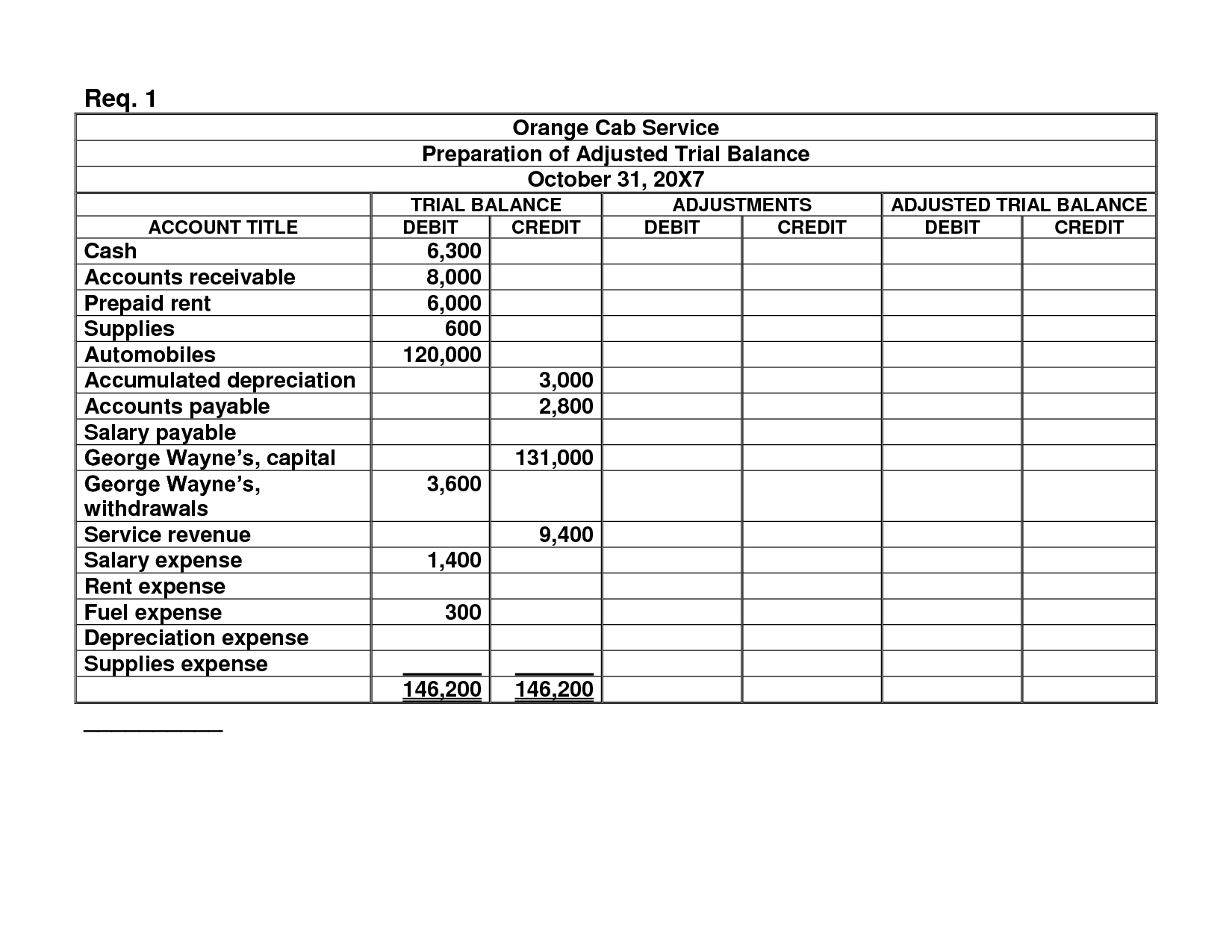

Adjusted trial balance.

BooksTime is not responsible for your compliance or noncompliance with any laws or regulations. This part of the company’s functioning is one of the most important. The correct organization of bookkeeping will allow an entrepreneur to avoid penalties, which are enforced by regulatory authorities in case of violations.

Benefits of Proper Accounting

To prepare a post-closing trial balance, the accountant or bookkeeper starts with a trial balance that lists all accounts with their debit or credit balances. Temporary accounts, such as revenue and expense accounts, are closed at the end of the accounting period, and their balances are transferred to permanent accounts, such as retained earnings. The following post-closing trial balance was prepared after posting the closing entries of Bold City Consulting to its general ledger and calculating new account balances.

Role in Verifying Accounting Accuracy

- Temporary accounts record revenues and expenses, resetting yearly.

- As you can see, the accounts are generally listed in balance sheet order starting with the assets followed by the liabilities and then equity accounts.

- A post-closing trial balance is a financial report prepared at the end of an accounting period to ensure that all temporary accounts have been closed and the company’s books are balanced.

- Adjustments ensure prepaid expenses are spread out as needed, and depreciation on assets is rightly expensed.

- In any case, they are an important concept and they officially represent the end of the process.

The post-closing trial balance highlights only these permanent accounts, which are crucial for understanding a company’s equity. It’s crucial to know all balance sheet accounts with balances that aren’t zero. This isn’t just good to do; it’s a main pillar of financial accounting. With the change from manual to software-led checks, one might ask if this step is still vital today. As balance sheet entries are listed in the trial balance, it is done similarly to the balance sheet with first assets, then liabilities, and then equity. Both the debits and credit totals are calculated at the end, and if these are not equal, one can know there must have been some mistake in preparing the trial balance.

Business

This resets revenue, expense, and owner’s drawing accounts to zero. It affects important financial measures like the earnings retention ratio. The Income Summary account is where these entries are summarized, reflecting a business’s profit. When a fiscal year ends, net income goes to retained earnings. This shows how a company plans to distribute profit in the future.

The Income Summary account would have a credit balance of 1,060 (9,850 credit in the first entry and 8,790 debit in the second). First, identify the accounts that possess balances, and if closing entries were performed correctly, these should simply be those on your company’s balance sheet. It helps to prepare your general ledger for the new accounting period and closes out balances in both expenses and revenue accounts. While it differs from an adjusted trial balance in purpose and content, both serve as crucial tools to ensure the accuracy of financial records and statements. These accounts carry their balances into the next accounting period and are used to prepare the financial statements.

Compiling a post closing trial balance is essentially the same as for unadjusted and adjusted trial balances. The main purpose of PCTB, as you know, is to make sure the credits and debits are what are commuter transit tax benefits and how do they help me now balanced, and it’s the last effort before closing the reported period for good. Unlike the usual Trial balance, there are no unadjusted or adjusted variations, it’s all done in one go.

Knowing the difference between temporary and permanent accounts helps in understanding their roles in accounting. Temporary accounts record revenues and expenses, resetting yearly. Permanent accounts carry forward their balances, crucial for financial analysis and assessing a company’s worth. A pre-closing trial balance shows all current account balances. But, a post-closing trial balance only shows permanent account balances. For instance, accounts payable and cash stay the same between the pre-closing and post-closing trial balances.

Since temporary accounts are already closed at this point, the post-closing trial balance will not include income, expense, and withdrawal accounts. It will only include balance sheet accounts, a.k.a. real or permanent accounts. An adjusted trial balance is prepared after adjusting entries are made at the end of an accounting period. Adjusting entries are made to record any transactions that occurred but were not recorded during the period or correct any accounting records errors.

They can also use such reports to compute financial ratios. Financial ratios are mathematical formulas that provide business owners and managers with indicators to measure against a competing company or industry standard. Financial ratios are a performance management technique using accounting information. Temporary accounts are used to record transactions for a specific accounting period, such as revenue, expense, and dividend accounts. A trial balance only contains ending balances of your accounting accounts, while the general ledger has detailed transactions of the accounts.

It helps avoid 60% of common errors, building trust and a solid reputation. At year-end, these accounts move their totals to the shareholders’ equity. This is done on the balance sheet, where accounts are permanent. Before that, it had a credit balance of 9,850 as seen in the adjusted trial balance above. You probably noticed that a post closing trial balance looks a lot like a balance sheet in the format of a trial balance.