Others use a paper checkbook, and balance it each month, to keep a record of any written checks and other transactions. You can also opt to use a simple notebook or spreadsheet for recording your transactions. Before you reconcile your bank account, you’ll need to ensure that you’ve recorded all transactions from your business until the date of your bank statement. If you have access to online banking, you can download the bank statements when conducting a bank reconciliation at regular intervals rather than manually entering the information. A company prepares a bank reconciliation statement to compare the balance in its accounting records with its bank account balance. A bank reconciliation statement is a valuable internal tool that can affect tax and financial reporting and detect errors and intentional fraud.

On the other hand, a small online store—one that has days when there are no new transactions at all—could reconcile on a weekly or monthly basis. We’ll go over each step can a company declare a dividend that exceeds eps of the bank reconciliation process in more detail, but first—are your books up to date? If you’ve fallen behind on your bookkeeping, use our catch up bookkeeping guide to get back on track (or hire us to do your catch up bookkeeping for you). If you use the accrual system of accounting, you might “debit” your cash account when you finish a project and the client says “the cheque is going in the mail today, I promise! Then when you do your bank reconciliation a month later, you realize that cheque never came, and the money isn’t in your books (even though your bookkeeping shows you got paid).

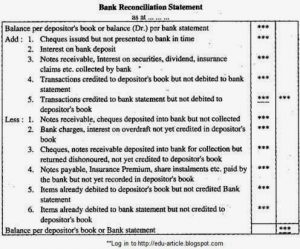

Adjusting Discrepancies Between Books and Bank

Likewise, ‘credit balance as per cash book’ is the same as ‘debit balance as per passbook’ means the withdrawals made by a company from a bank account exceed deposits made. These fees are charged to your account directly, and reduce the reflected bank balance in your bank statement. These charges won’t be recorded by your business until your bank provides you with the bank statement at the end of every month. Deposits in transit, or outstanding deposits, are not showcased in the bank statement on the reconciliation date.

Bank reconciliations may be tedious, but the financial hygiene will pay off. There are several reports – such as the The Reconciliation Discrepancy Report, the Missing Checks Report, and the Transaction Detail Report – that can help you cash flow worksheet identify discrepancies quickly. Cash management software can integrate with many data sources, ensuring consistency in data requirements and quality.

A bank reconciliation is the process by which a company compares its internal financial statements to its bank statements to catch any discrepancies and gain a clear picture of its real cash flow. The information on your bank statement is the bank’s record of all transactions impacting the company’s bank account during the past month. Compare the ending balance of your accounting records to your bank statement to see if both cash balances match. Reconciling bank statements with cash book balances helps your business know the underlying causes of these balance differences. Once the underlying cause of the difference between the cash book balance and the passbook balance is determined, you can then make the necessary corrections in your books to ensure accuracy. The cash account balance in an entity’s financial records may also require adjusting in some specific circumstances, if you find discrepancies with the bank statement.

Know that banks might also make errors

Interest is automatically deposited into a bank account after a certain period of time. So the company’s accountant prepares an entry increasing the cash currently shown in the financial records. After adjustments are made, the book balance should equal the ending balance of the bank account. Miscellaneous debit and credit entries in the bank statements must be recorded on the balance sheet. If there are any differences, adjust the balance what other types of contra accounts are recorded on the balance sheet sheet to reflect all transactions. Conducting regular bank reconciliation helps you catch any fraud risks or financial errors before they become a larger problem.

- Bank errors are mistakes made by the bank while creating the bank statement.

- It is up to you, the customer, to reconcile the cash book with the bank statement and report any errors to the bank.

- It’s possible that a banking error has occurred or that you have been charged for something you were unaware of.

- More specifically, a bank reconciliation means balancing your bank statements with your bookkeeping.

- As a result, the balance shown in the bank passbook would be more than the balance shown in your company’s cash book.

Journal entries, also known as the original book of entries, refer to the process of recording transactions as debits and credits, and once these are recorded, the general ledger is prepared. As a result of these direct payments made by the bank on your behalf, the balance as per the passbook would be less than the balance as per the cash book. Therefore, an overdraft balance is treated as a negative figure on the bank reconciliation statement. After adjusting all the above items, you’ll end up with the adjusted balance as per the cash book, which must match the balance as per the passbook. Bank reconciliation helps to identify errors that can affect estimated tax payments and financial reporting. Cash management software allows businesses to gather real-time cash positions across the organization, helping to make better business decisions based on accurate data.

Whereas, credit balance as the cash book indicates an overdraft or the excess amount withdrawn from your bank account over the amount deposited. This is also known as an unfavorable balance as per the cash book or an unfavorable balance as per the passbook. If you want to prepare a bank reconciliation statement using either of these approaches, you can use the balance as per the cash book or balance as per the passbook as your starting point. When done frequently, reconciliation statements help companies identify cash flow errors, present accurate information to investors, and plan and pay taxes correctly. They can also be used to identify fraud before serious damage occurs and can prevent errors from compounding.

Step 5: Record All Adjustments As Per Cash Book Into Your Company’s General Ledger Cash Account

It is essential for maintaining accurate business financial records, which helps in tax filing and gives an overall idea of the company’s finances. We strongly recommend performing a bank reconciliation at least on a monthly basis to ensure the accuracy of your company’s cash records. A monthly reconciliation helps to catch and identify any unusual transactions that might be caused by fraud or accounting errors, especially if your business uses more than one bank account. Cross-checking bank statements with the balance sheet at least once every month during the closing process is necessary. If the business has a high volume of transactions, reconciliations should be done more frequently.

A bank reconciliation compares a company’s cash accounting statements against the cash it has in the bank. A bank reconciliation is used to detect any errors, catch discrepancies between the two, and provide an accurate picture of the company’s cash position that accounts for funds in transit. You’ll need a few items to perform a bank reconciliation, including your bank statement, internal accounting records, and a record of any pending cash transactions (either inflows or outflows). Consider performing this monthly task shortly after your bank statement arrives so you can manage any errors or improper transactions as quickly as possible.